Government spending taken to the ultimate

Tom Mackey (TMMBA alumnus, Class of 2009)

I ran across this well done article telling the story of entire Chinese cities being built, just to “grow the economy”:

http://www.theblaze.com/stories/amazing-video-emerges-of-chinas-ghost-cities/

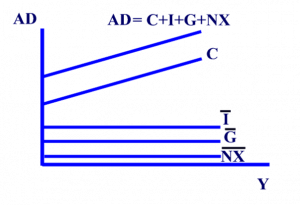

The video is about 15 minutes long, but well done. In it, a Hong Kong housing expert estimates that there are 64 Million (and growing) empty apartments and homes in China. They are asking prices roughly equivalent to what you would expect to see in the Seattle area, require a 50% down payment, and loans must be repaid in three years. The draconian interest terms have so far prevented a hyperactive mortgage bubble, but they certainly have a glut of housing that no one can afford. In addition, they are tearing down the places where people are actually living in order to build yet more apartment buildings — which is contributing to growing social unrest. When you consider the relatively small amount government spending contributes to Aggregate Demand, it is obvious that the Chinese government is spending money by the boat load in order to prop up their economy. When this housing construction bubble bursts, there is no telling what will happen. Remember that C = Consumers propensity to spend, I = investments (Mostly in *our* treasuries, by the way), G = Government purchases (the ghost cities), and NX = Foreign exchange (Also huge for China). What they do not have is much “C” — the thing that is required to really grow an economy (i.e., true creation of wealth where money is created out of thin air through the fruition of ideas into goods and services).

Interesting — if they sell our securities to continue the building, they will collapse our economy, leading to a sudden drop in their NX, which will collapse their economy. Mutual Assured Destruction of the economic kind. Yet, at some point, something has to give. I saw a Twilight Zone episode one time where we had latched on to something in another dimension, and both sides were pulling so hard that neither side could release without destroying everything, or let up for fear of turning that dimension inside out — Tiger by the Tail, I think, was the name of it. Pretty apt description of what we have with China. Below, the Aggregate Demand vs. Y (Goods) chart from one of Karma’s lectures:

Tom Mackey, TMMBA Alum (’09)