Innovative Empirical Methods Yield Unique Insights into Minority Entrepreneurship

In January 2016 and August 2016, the Kauffman Foundation sponsored two power-packed research conferences on minority entrepreneurship. The conference organizers – Timothy Bates, William Bradford, Alicia Robb and Robert Seaman – selected conference participants from the pool of scholars who responded to the request-for-proposal, “Seeking New Insights and Potential Sources of New Entrepreneurial Growth: Minority Entrepreneurship.”

Nine research teams presented work on wide-ranging topics such as:

- the impact of STEM education programs on African-American entrepreneurship (Zorana Jones and Colleen Casey, University of Texas Arlington),

- the disbandment logics of Hispanic entrepreneurs (Diana Hechavarria, University of South Florida),

- the impact of the entrepreneurial entry decision on the success of ethnic minority entrepreneurs (Ayal Kimshi, Hebrew University, Jerusalem)

- the role of minority entrepreneurs in the Boston ecosystem (Banu Ozkazanc-Pan, University of Massachusetts, Boston).

Despite the diversity of subject matter, all of the scholars utilized unique data and/or employed novel yet rigorous analytical techniques. This striking commonality across research endeavors highlighted the complex nature of minority entrepreneurship.

Here, I will focus on five research projects included in a forthcoming special issue of Small Business Economics.

Compelling Controls

Isolating the effect of race and/or ethnicity from other potentially correlated variables such as socio-economic status, education, and industry choice can be problematic. Although some of these possible correlates can be observed, measured, and included in empirical models, others may not be as accessible and the resulting findings may be affected by omitted and unobserved variable bias.

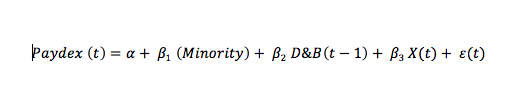

In “Testing for Racial Bias in Business Credit Scores”, Alicia Robb and David Robinson regressed history based repayment activity Paydex credit scores on lagged expectations based repayment probability Dun & Bradstreet (D&B) commercial credit scores:

where: X = a vector of control variables; Minority = racial or ethnic dummy variable; and = an error term.

A positive coefficient on would indicate the presence of racial bias because the actual repayment histories of minority business owners were better than those predicted by their D&B commercial credit scores. The control variables in X isolated some of the impact of minority status. Robb and Robinson argued that any other omitted and unobserved variables correlated with race can be reasonably assumed to be the same for the Paydex and D&B scores.

Robb and Robinson found that minority entrepreneurs are not unduly penalized in their business credit scores. Their technique of using two independently formulated yet similar measures as dependent and independent variables respectively addresses the problem of omitted and unobserved variable bias ingeniously.

Baylee Smith and Angelino Viceisza employed an equally inspired approach in their study, “Bite Me! ABC’s Shark Tank as a Path to Entrepreneurship” . They created a unique dataset consisting of all entrepreneurs and firms on shows that aired between August 2009 and May 2016 to determine whether the post-show impact of receiving an intention to fund (ITF) from the “Shark” angel investors differed for minority and non-minority participants. Given that only a portion of the entire interaction between the “Sharks” and a given entrepreneur is actually aired, the authors needed to control for information that is observed by the “Sharks” but not seen by the audience.

They subsequently created controls on as many observable variables as possible on the pre-Shark Tank and pre-ITF characteristics of the entrepreneurs and firms from a wide range of public data sources and tested them across ITF decisions. They argued that if entrepreneurs and firms are similar on average on these observed variables across ITF decisions, then the likelihood that unobserved variables strongly affected the post-show impact of ITF decisions would be significantly reduced.

Smith and Viceisza found that only two of 26 pre-ITF characteristics – the number of people pitching and their relative attractiveness as determined by a beauty app – were significant determinants of receiving an ITF. Since these were logical and expected findings, they concluded that unobserved variables did not unduly influence ITF decisions. In their analysis, minority entrepreneurs and firms did not face a differential impact from receiving ITF decisions.

Investigating Outcomes

Powerful yet difficult to measure market and social dynamics can influence the outcomes of minority entrepreneurs. Accordingly, thoughtful empirical strategies and techniques are required to unearth the complex story behind these observable outcomes.

In “Are Minority-Owned Businesses Underserved by Financial Markets? Evidence from the Private Equity Industry”, Timothy Bates, William Bradford, and William Jackson III, investigated discrimination in private equity markets by examining financial returns on realized investments in minority and White-owned firms by private equity funds. They used generalized least squares random effects regression models to demonstrate that investments in minority businesses are more profitable than investments in comparable White-owned firms. Bates et al. employed the logic of restricted choice and reservation price differentials to argue that minority entrepreneurs sell equity for less because they have fewer alternatives for financing. Thus, discrimination impacts minority entrepreneurs in private equity markets in the form of reduced bargaining power.

Shelton and Minniti conducted a similar type a similar type of deductive empirical investigation on the product market side in “Enhancing Product Market Access: Minority Entrepreneurship, Status Leveraging, and Preferential Procurement Programs” by examining the product market choices of Black, Hispanic and White entrepreneurs. They used archival data from the Inc. 5000 in 2010, 2013 and 2015 to determine if product market choices varied by ethnicity, and 20 in-depth qualitative case studies to determine the underlying causes of any variation. They discovered that minority entrepreneurs faced discrimination in serving the mainstream private household consumers targeted by many White entrepreneurs. The negative perception of their minority status limited their opportunities for business survival and growth by effectively excluding them from the large mainstream US household consumer market.

However, the authors also found that corporate and government set-asides mitigate the impact of private consumer discrimination by providing incentives for large lucrative business and public sector clients to conduct business with minority entrepreneurs. Minority status became a positive instead of a negative. In effect, these programs allow these entrepreneurs to leverage their minority status, thereby expanding the product markets they can access.

Shifting Focus

Changing the research focus from minority entrepreneurs to key external actors provides greater understanding of the ecosystem in which these firms operate. Amol Joshi, Todd Inouye and Jeffrey Robinson focused on grantor federal agencies instead of recipient firms in their study of innovation production policies entitled, “How does Agency Workforce Diversity influence Federal R&D Funding of Minority and Women Technology Entrepreneurs? An Analysis of the SBIR and STTR programs, 2001-2011.”

They used Federal data on the race, ethnicity and gender of the employees at the grantor as a proxy for the value various agencies placed on diversity and for the level of homophily involved in granting innovation research awards. Binary logistic regression models based on 69,771 technology research awards (52,286 Phase I and 17,485 Phase II) and Small Business Administration data demonstrated that greater workforce diversity in granting agencies benefitted all firms rather than only providing a special boost to minority entrepreneurs. More diverse agencies tended to make more awards.

As a result, the authors identified how greater workforce diversity could lead to greater growth for a federal agency. Greater workforce diversity can enrich the talent pool. An enriched talent pool can access a wider range of innovative input through greater homophily, which can in turn improve innovation output and enhanced organization performance. Enhanced organization performance can lead to a higher total budget allocation.

Final Thoughts

The study of minority entrepreneurship offers great rewards, but is also fraught with potential problems, such as measuring subtle and hard-to-quantify factors, controlling for unobserved and omitted variables, and facing the lack of necessary data and shortcomings in traditional data sources. However, as the saying goes, necessity is the mother of invention, and the scholars in the studies discussed here rose to the challenge. They thoughtfully and carefully developed inventive original datasets, devised novel analytical techniques and viewed phenomena from fresh perspectives. In doing so, they revealed important new understandings for this growing literature. The trailblazing empirical techniques highlighted their work have the potential for useful applications in numerous other areas of research.