Leaders to Legends: the macro- and micro-economics of the Nasdaq

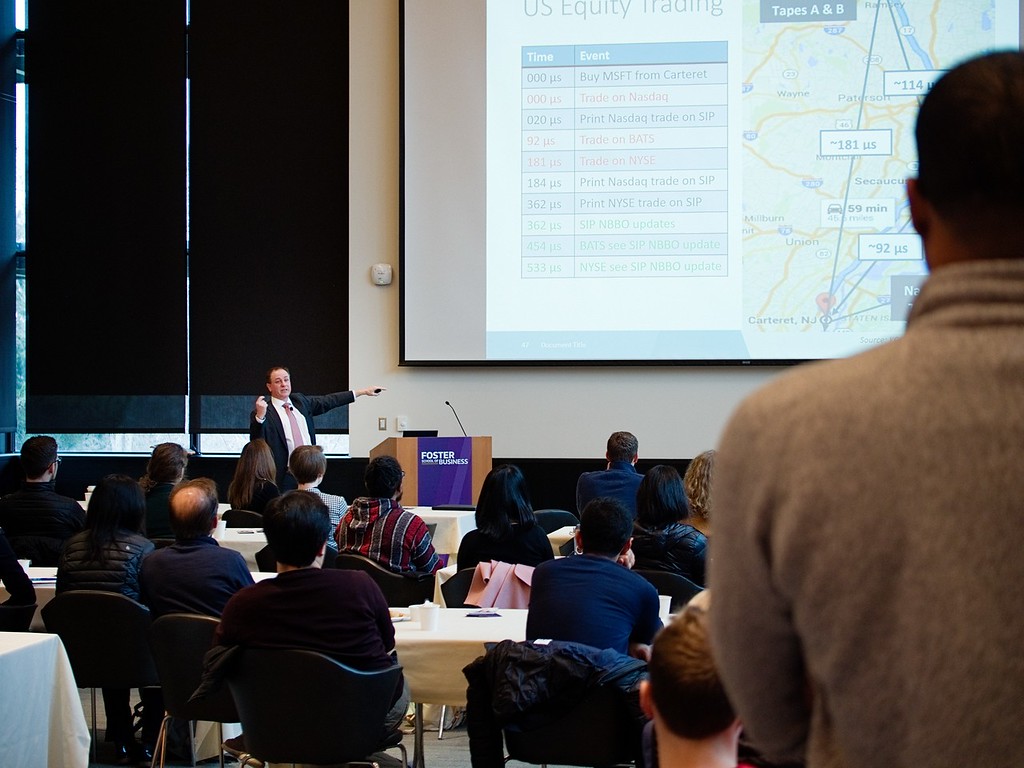

Phil Mackintosh, the chief economist of the Nasdaq stock exchange, demonstrated his extraordinary range at the March 6 edition of the “Leaders to Legends” breakfast series at the University of Washington Foster School of Business.

Phil Mackintosh, the chief economist of the Nasdaq stock exchange, demonstrated his extraordinary range at the March 6 edition of the “Leaders to Legends” breakfast series at the University of Washington Foster School of Business.

Mackintosh opened with a satellite-view analysis of macroeconomic trends that effect the world’s second-largest stock exchange (and the investors and firms who meet there). He offered his take last December’s market turbulence, which he blamed on the entangling domestic and global concerns over the government shutdown, uncertainty over Brexit, a growing trade war, the decelerating Chinese economy, and fears of the Fed raising interest rates.

He admitted that most of the world was still struggling to dig out from the financial crisis, but remained cautiously optimistic about the US economy. “We can’t ignore global challenges,” Mackintosh said. “But we actually have a pretty strong economy here. People are getting jobs, salaries are going up, consumers are still confident. Provided we can keep that going, the US economy should stay pretty stable. We might be able to insulate ourselves. The dynamics that keep us going shouldn’t be affected so much by global trade.”

After a trip to the macro, Mackintosh effortlessly zoomed in—way in—to the microeconomics of the equity markets, including a discussion of ETFs (exchange-traded funds), HFTs (high-frequency trading) and that most precious asset and costly liability of modern investing: speed.

He began with a trip down memory lane, to a time not so long ago when floor traders would hold a phone to each ear, toggling between customer and market in a real-time effort to accelerate trading as a competitive advantage.

Fast forward to today, when trading occurs at breathtaking velocity. “Computers have created a much more efficient feedback loop and the information gets out to the market much more quickly now than it ever used to,” Mackintosh said.

How quickly?

He reported that in 2007, the Nasdaq could print stocks to the tape inside a quarter-second (about 250,000 microseconds). Today, it takes only 17 microseconds from instant a trade is made to the instant that it appears in the market.

He added that this ever-increasing speed does have one ultimate physical limitation. Since most equity transactions take place at data centers in New Jersey, the distance between them and the leading markets in New York City adds microseconds to any trade, even traveling at the speed of light. This “natural geographic latency” means it’s physically impossible to synchronize the market.

He added that this ever-increasing speed does have one ultimate physical limitation. Since most equity transactions take place at data centers in New Jersey, the distance between them and the leading markets in New York City adds microseconds to any trade, even traveling at the speed of light. This “natural geographic latency” means it’s physically impossible to synchronize the market.

“This is why so many high-frequency traders have physics degrees,” Mackintosh said. “Because they get this stuff.”

Next up in the Leaders to Legends series: Nancy Zevenbergen, President & Chief Investment Officer of Zevenbergen Capital Investments LLC (April 10), and Etienne Patout, CEO of Theo Chocolate (April 24).