V, K or W? Foster panel discusses pandemic recovery at a special State of the Economy Forum

The ongoing economic crisis resulting from the COVID-19 pandemic prompted a special fall edition of the Foster School’s usually annual State of the Economy Forum October 8 on Zoom.

The by-now ubiquitous grid of familiar faces included Chris Mefford (MBA 2002), founder, president and CEO of economics consulting firm Community Attributes, Debra Glassman, principal teaching professor of finance and business economics, and Ed Rice, a professor of finance and business economics.

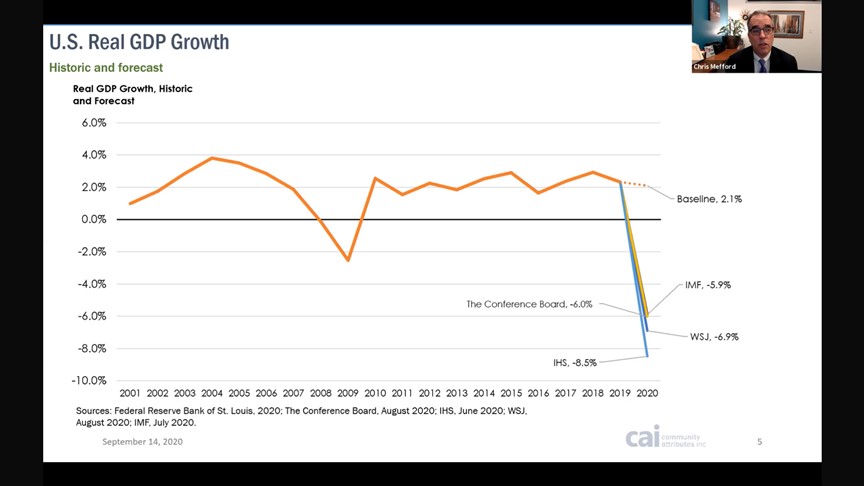

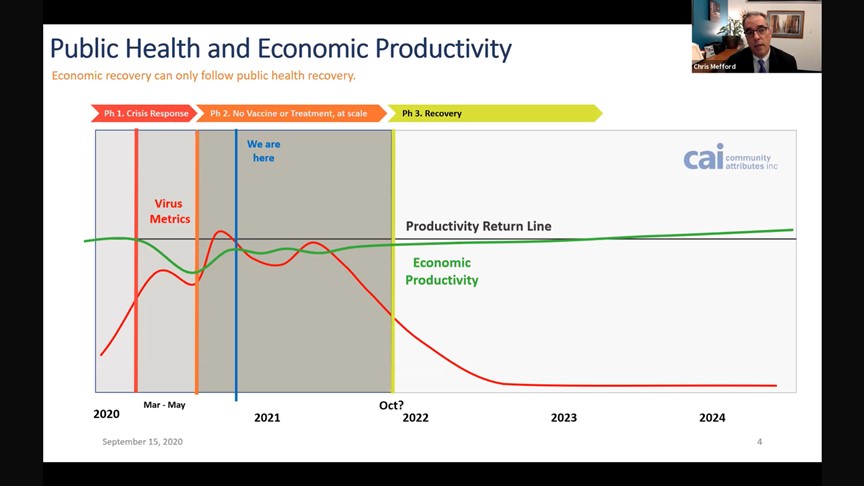

Updating his report on the crisis at the April forum, Mefford painted a sobering picture of national and local economies still reeling from a pandemic that continues to wreak havoc around the world. He called attention to the less-publicized plight of mid-sized businesses which are as essential to the economy as they are difficult to restart once they’re gone. And he lamented the fact that that existing societal inequities have been exacerbated by the pandemic.

“Technology has been heroic. It’s kept productivity at higher levels than I would have expected,” he said. “Until we get control of the virus, though, we’re really just trying to adapt and get by.”

Questions, questions

The panel fielded a wide range of questions from the audience, which kicked off some lively exchanges.

On the “shape” of recovery, Glassman argued that a quick-rebounding V looks all but impossible due to the persistence of the pandemic that has triggered recession. She explained that a K-shaped recovery would illustrate the inequities the pandemic has laid bare: high-income earners are more likely to stay employed and even build wealth during the pandemic while low-income people have been hit harder and continue on a downward trajectory. A W-shaped recovery would denote a double-dip, the second after a brief economic recovery over summer “I don’t know what letter you get when you combine a K and a W,” she said, suggesting that’s where we’re headed.

Rice opined that a “grotesque failure of politics” has prevented further federal aid—a “no-shrivel package”—from being approved to replace the depleted CARES Act while so many people and businesses remain in dire straits.

On the future of work, Rice noted that the workplace is constantly evolving and being reorganized, and the pandemic is simply “hastening” things. Glassman added that the acceleration of innovations in remote work, e-commerce, telehealth and contactless service will likely settle into a new normal. “Digitization and automation have accelerated with every recession we’ve had going back to the 1980s,” she said. “The same is happening now, but on steroids. A recent McKinsey article had a title that I think really sums it up: ‘If you’re feeling whiplash, it might be the ten years forward we just jumped in the last 90 days.’ ”

On the prospect of inflation, Glassman argued that it’s unlikely due to a number of factors, but Rice voiced concern that inflation will prove to be the cheapest way of controlling the nation’s snowballing debt. “I used to say that the national debt is just not a big enough problem unless things get completely out of hand,” he said. “Well, guess what? We’re at completely out of hand right now.”

On why the stock market is so high when the economy is so low, Glassman referred back to the K-shaped recovery. Those with higher income and savings are weathering the pandemic and investing in the stock market. Mefford added that, with interest rates so low, investors are betting on good times to follow, no matter how long it takes. Rice cautioned: “It’s important to understand that the economy is not the stock market… most of the firms that are doing poorly are medium sized or small, which are not represented at all in the stock market.”

On the pandemic’s furthering concentration of wealth, the panelists agreed a redistribution needs to occur, one way or another. Rice argued that the loss of wealth to the pandemic needs to come from somewhere, and the concentration of wealth puts the burden is on the wealthiest. “Rich people are going to have to lose a lot of their wealth because of the pandemic,” he said. “There’s no other wealth to take… When poor people lose their wealth, they get negative. They die owing money.”

On the pandemic’s furthering concentration of wealth, the panelists agreed a redistribution needs to occur, one way or another. Rice argued that the loss of wealth to the pandemic needs to come from somewhere, and the concentration of wealth puts the burden is on the wealthiest. “Rich people are going to have to lose a lot of their wealth because of the pandemic,” he said. “There’s no other wealth to take… When poor people lose their wealth, they get negative. They die owing money.”

The solution, he said, was some kind of universal basic income, “where we make sure that poor people aren’t going to die. They’re not going to shrivel.”

“That just took my breath away,” Glassman replied. “I never thought Ed would be advocating for universal income!”

She added that future tax structure could address economic disparity. “I think higher taxes are coming, and politicians would be smart to start preparing us… In the meantime—the next one to three years—we’re going to see even bigger deficits. Even someone as conservative as Fed Chair Jerome Powell is saying the risks of overdoing it in terms of expansionary fiscal policy are smaller than the risks of doing too little.”

On the pandemic’s effect on supply chains, Glassman suggested that the unrelenting push to reduce cost may face a reckoning. “We may pay higher prices for this resilience,” she said, noting that there may be a move toward “de-globalization,” or supply chains that stay within a nation or region.

If there is a requisite de-globalizing on the rise, Rice chalks it up a “tremendous failure of world politics” He noted that global challenges like pandemics and climate change are impossible to solve by individual governments—but the world has moved increasingly toward nationalism. “Everything is America first, Brazil first, Philippines first. We have had a decline in international alliances and trusted partners who could work to solve things together… A lot of these most serious problems require alliances and joint effort.”

On the trade war with China, all agreed that the current unilateral approach and escalating tariffs is folly, but friction is likely to continue. “Both Republicans and Democrats have issues with China,” Glassman said. “Their approaches will be very different. The Trump administration has taken a unilateral approach to trade… and imposes tariffs to reduce trade deficits (and, by the way, that does not work well; our trade deficit is reaching record highs). A Biden administration is also likely to be concerned about trade with countries like China, but more likely to act multilaterally.” This means reforming old trade alliances, working through the WTO and focusing on issues like human rights. “In either case,” Glassman said, “we’re likely to see continued use of tariffs.”

On challenges facing the local economy, Mefford took a bigger-picture view on the overall business climate. “One of the things we’ll have to do to restore our economic expansion is to overcome perception growing across the world that Seattle doesn’t like having successful businesses here. We’ve accepted growth as an input and didn’t think we need to market ourselves. But this is not the way it’s going to be moving forward. There are places all over the country that invest millions and millions of dollars in the name of business recruitment… The city of Seattle needs a whole new city council or at least seven new council members who won’t punish successful companies.”

State of the Economy Forum panelists (clockwise from bottom left) Ed Rice, Chris Mefford, Debra Glassman and moderator Andrew Krueger.

Rice concurred. And then some. “Why do we have representative government?” he asked. “Representative government takes things in a more systematic way to change emotion into reason. And because we have people who specialize in knowing about things, who have time to do planning so we can adjust to the shocks in our life in a reasonable and effective way instead of in an emotional and perhaps destructive way… That’s the opposite of this city council.”

“You may have launched your city council campaign tonight,” quipped moderator Andrew Krueger, the director of alumni and media relations at Foster.

“We’ll be the ones wearing t-shirts that say ‘Incentives matter,’ ” joked Mefford, citing the legendary professor’s mantra.

Reasons for hope

To wrap the evening on a hopeful note, the panelist were asked to produce a silver lining in a year that has been described as a “dumpster fire” and worse. All three arrived at a similar theme: resilience.

“I hope that, when we come out of this, there’s a renewed energy that people take when they’ve come through a hard time, and apply that to take risks they wouldn’t take otherwise,” Mefford said.

Rice has taken heart in the rising entrepreneurial activity during the pandemic. “One of the reasons that America is special is we have people who are willing to think in very creative ways to change things for the better,” he said. “This increase in the number of startups is at least partially due to that spirit of innovation.”

Glassman added her faith that a burst of economic growth will follow the pandemic. But she also celebrated the accelerated migration toward remote work and flexible schedules. “To the extent that some work from home is permanent, I’m looking forward to less traffic. Even a 10 percent reduction in commute time would be really nice!”

Watch the full State of the Economy Forum video.

2 Responses

Leave a Reply

You must be logged in to post a comment.

Thank you so much, Ed. You are still as insightful as ever.

David Olson (MBA class of ’87)

These insights are really helpful. Thanks Ed for sharing these important details.