Foster panel begins to envision pandemic recovery at 20th State of the Economy Forum

Groundhog Day? It felt more like Groundhog Year at the Foster School’s 20th annual State of the Economy Forum, in which the conversation continued to be dominated by the COVID-19 pandemic, now barreling into its 16th month inflicting physical, psychological and economic mayhem across the planet.

Groundhog Day? It felt more like Groundhog Year at the Foster School’s 20th annual State of the Economy Forum, in which the conversation continued to be dominated by the COVID-19 pandemic, now barreling into its 16th month inflicting physical, psychological and economic mayhem across the planet.

On the agenda were all the greatest hits of COVID-19: unemployment, debt, economic stimulus, inflation, US-China relations, long-term changes to the job market, length (and shape) of recovery and the Seattle region’s challenges and opportunities ahead.

These were hashed out, in entertaining fashion, over two fly-by hours on Zoom by the familiar panel of Foster School experts: Chris Mefford (MBA 2002), founder, president and CEO of economic consulting firm Community Attributes; Debra Glassman, teaching professor of finance and business economics; Thomas Gilbert, associate professor of finance; Ed Rice, professor of finance and business economics; and moderator Andrew Krueger, senior director of alumni and media engagement.

If the topics they tackled remained riddled with the struggles and uncertainty of the past year+, there was one thing new: a measure of hope the panelists allowed themselves despite a future unknown—but far less unknown than a year or even six months prior.

The conversation even kindled a few sparks of normalcy. Mefford renewed calls to Seattle politicos to stop waging war against business. Gilbert denounced irrational investing (specifically on wax-winged fliers like GameStop). Glassman and Rice sparred anew over government interventions in the economy. And Rice, whose jests about running for mayor of Seattle elicit fervid support among former students, inveighed against overburdening target tax rates and pontificated on the important distinction between “following the science” and “considering” it—alongside risk assessment, economic jeopardy and other common-sense factors—when making policy in a pandemic.

It almost felt like normal times.

Wresting control from the virus

Mefford’s prelude on the most telling economic trends was a few shades sunnier than the previous couple of outings. His chromatic gallery of graphs and charts told the story of an economic reality that has turned out somewhat less dire than the over-the-cliff scenario projected a year ago.

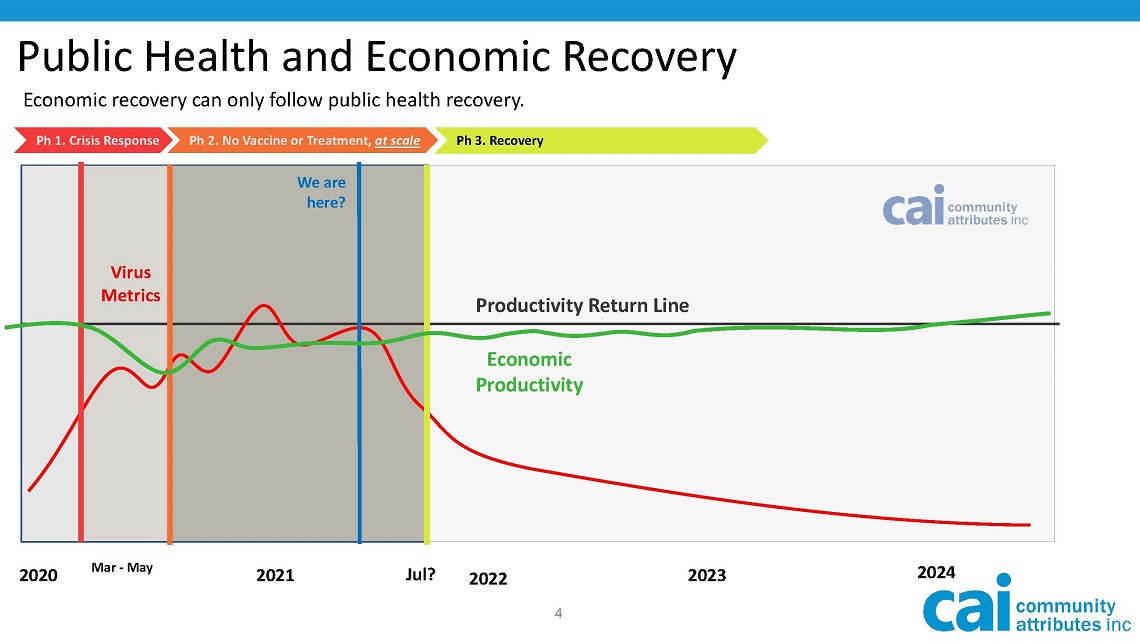

Getting control of the virus has always been key to resuming economic growth. And, with the introduction and rapid dissemination of multiple vaccines, he plotted the United States nearing the end of his phase 2 and at the cusp of phase 3: recovery.

“Now we’re deep into phase 2, thankfully,” Mefford said. “This period where the vaccine hasn’t quite been rolled out at scale. And we all know painfully how critical it is to getting to herd immunity or the point where the virus no longer has control over the economy. At this point, to a large extent, it still does.”

“Now we’re deep into phase 2, thankfully,” Mefford said. “This period where the vaccine hasn’t quite been rolled out at scale. And we all know painfully how critical it is to getting to herd immunity or the point where the virus no longer has control over the economy. At this point, to a large extent, it still does.”

But he produced many other positive indicators. GDP and savings rates have increased markedly, driven in part by massive infusions of federal stimulus (a topic debated vehemently later). The job market has improved steadily from its nadir, even amidst third and fourth waves of infections. The influx of cash and the return of jobs have allowed precarious state governments to weather the pandemic better than anticipated.

“There are still too many positive cases in Washington state and it’s wishful thinking that the red curve (COVID-19 infections) tapers off the way I’ve represented it on the screen in the coming weeks,” Mefford said. “As it does, though, we will see economic productivity start to return. It will continue to be volatile, and it will not recover as quickly as we want it to.”

Signs of resilience

Mefford pointed to solvent state and local governments, and steadily recovering employment figures, even before vaccines arrived, as harbingers of recovery and signs of resilience. “We’ve learned how to be productive, even in a pandemic, he said.

As another signal of the strength and resilience of the US economy, Gilbert cited the finance professor’s favorite economic indicator: the stock market. Acknowledging the effect of government stimulus and the technology enabling remote work for many in the professional class, he noted the dramatic rebound in a roll call of market indices representing every business sector and size. Not that the market is the economy, but still…

“Prices being forward looking, this is a good signal,” he said. “And these prices, having rebounded in this ‘swoosh,’ I think, is consistent with my cautious optimism.”

Glassman cautioned that those euphoric stock prices may be a side effect of differential experiences in the pandemic and its resulting recession. She argued that predictions of a “K-shaped” recovery—rising fortunes for high earners and additional struggle for low-income folks—have largely come to pass. Evidence abounds in uneven savings rates, job growth and booming markets.

Glassman cautioned that those euphoric stock prices may be a side effect of differential experiences in the pandemic and its resulting recession. She argued that predictions of a “K-shaped” recovery—rising fortunes for high earners and additional struggle for low-income folks—have largely come to pass. Evidence abounds in uneven savings rates, job growth and booming markets.

Disproportionately impacted by job loss and infection rates, “the picture for the lower leg of the K is still very negative,” she said. “The upper leg of the K is the higher-income households… What did they do with their savings? They’ve been driving up housing prices, they’ve been driving up stock prices, they’ve been driving up Bitcoin prices.”

Danger ahead

In addition to the inequity exacerbated by the pandemic, the panel voiced other concerns looming.

Gilbert and Glassman noted the rebounding job market continues to leave out many lower-income workers—and untold numbers who have completely given up on finding jobs. And, with an accelerating trend toward automation during the crisis, many jobs are likely to never return.

While no one shared any urgent concern about inflation or the balooning national debt (other than the need to tame it before the next crisis), Rice returned to his fiscally conservative foundations after initially cheering emergency government stimulus. The target of his diatribe was both the scale and imprecision of this ongoing “massive government intrusion in the economy.” Adding up prior and proposed expenditures of stimulus dollars during the crisis amounts to between $15,000 and $22,000 per American, according to Rice’s calculations.

“I supported those original stimulus expenditures,” he said. “But now we’re a year later… These are huge amounts of money, with almost no plan whatsoever about how they are going to be spent… I think a year into the pandemic, we’ve got to be able to do better than that. $17 trillion is an astounding amount of money by any measure—almost a takeover of the economy by the federal government.”

Takeaways

On the bright side, Gilbert spoke in terms of the pleasant surprise of seeing his dire predictions about insolvency of state and local governments be proven wrong. Mefford agreed and added that government interventions—blunt as they may have been—have set the stage for a faster economic recovery than past recessions.

Rice, detouring from dollars and sense for a moment, spoke of the emotional recovery that he has begun to feel. “A few weeks ago, for the first time (since the pandemic began), I got on a plane. I’m fully vaccinated and I tested beforehand. I visited my daughter in Chicago who I hadn’t seen in a year. We had a few days and we did absolutely nothing, which is what we usually do. And it was such fun. It was amazingly fun. I was embarrassed at how much fun I was having doing nothing, with my daughter. This personal connection, the ability to give her a hug… it’s amazing.

“Even flying on the plane, looking down at the ground, I noticed how beautiful it looks. I mean, usually on a plane I just want to go to sleep.”

There also was excitement at the road ahead, no matter how bumpy.

“When the pandemic is finally behind us,” Glassman said, “I think it’s going to be quite like the Roaring ‘20s again, kind of an explosion of energy and creativity and change that may be good or may be not so good—but it will definitely be exciting.”

Buckle up.

Remembering Karma

For its 20th edition, the State of the Economy Forum opened with a fond remembrance of one of the driving forces behind its founding: Karma Hadjimichalakis, who died in 2011. One of only two UW faculty members, at the time, to earn the title of principal lecturer and recipient of 45 teaching awards at Foster, Karma’s SRO public economic forecast lectures evolved into the annual forum that has attempted to carry her wit and wisdom across two decades and three cycles of boom and bust.

For its 20th edition, the State of the Economy Forum opened with a fond remembrance of one of the driving forces behind its founding: Karma Hadjimichalakis, who died in 2011. One of only two UW faculty members, at the time, to earn the title of principal lecturer and recipient of 45 teaching awards at Foster, Karma’s SRO public economic forecast lectures evolved into the annual forum that has attempted to carry her wit and wisdom across two decades and three cycles of boom and bust.

“Former students, many of whom are with us tonight, talk about how they still look at the world around them through the economic lens that Karma helped them develop,” said Dean Frank Hodge. “She had a way of assessing each student’s knowledge of macroeconomic concepts and then explaining complex topics at a level that spoke to that individual student… Each and every one of them thought that Karma was talking just to them.”

“Karma had that rare ability to link theory with the real world, to make macroeconomics fascinating and, I dare say, even fun.”

Watch her legacy in the 2021 State of the Economy Forum.