Sharpe’s living laboratory

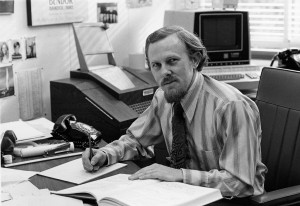

In keeping with the era’s zeitgeist, William Sharpe’s time on the Foster School faculty (1961-68) was radically experimental. “I’m a great believer that if you really want to learn a subject, you should teach it (which is probably not fair to students),” says the Nobel laureate in economics. “I wanted to learn a lot so I taught a lot of courses.”

In keeping with the era’s zeitgeist, William Sharpe’s time on the Foster School faculty (1961-68) was radically experimental. “I’m a great believer that if you really want to learn a subject, you should teach it (which is probably not fair to students),” says the Nobel laureate in economics. “I wanted to learn a lot so I taught a lot of courses.”

Among them were classes in microeconomics, finance, investing, computer science, statistics, and operations research. He also consulted organizations ranging from Boeing to IBM, McKinsey to Western Airlines.

In addition to his Nobel Prize-winning work on the Capital Asset Pricing Model, Sharpe published more than 20 papers during his Foster days. He also wrote two books—the first introducing the BASIC programming language and the second forecasting the economics of computers. His deep interest in programing led his push for the school’s first computer center (he claims the words “pooter center” were among his daughter’s first).

“My time at the UW was fabulous,” Sharpe says.

Rocky Higgins, an emeritus professor of finance whose tenure overlapped with Sharpe’s, says the impact of his scholarly explorations left a deep and positive impression on the school. “Bill was a supportive and enthusiastic colleague,” Higgins says. “He did a lot to create an atmosphere of collegiality and supporting unconventional thinking that lasted many years after he left.”

“A lot of people who Bill mentored or worked with have gone on to impressive careers in finance,” adds Nancy Jacob (BA 1967), Sharpe’s undergraduate research assistant who later became dean of the Foster School (1981-88) before running two investment firms of her own. “His impact on people is probably as important as his path-breaking research.”

Read about William Sharpe’s work at Foster to define the relationship between risk and return in the markets.