Dieselgate and the “perverse halo” of Volkswagen

Guest post by Abhishek Borah, an assistant professor of marketing at the Foster School.

Volkswagen is in dire straits. The German car company’s ongoing “Dieselgate” scandal could exact a catastrophic toll on its reputation, balance sheet and market cap.

But how is the recall of VW diesel cars affecting the competition? Are the negative effects of this scandal spilling over to other German brands? How about brands from other countries?

In a forthcoming Journal of Marketing Research paper that I co-authored with Gerard Tellis from USC’s Marshall School of Business, we found that brands from the same country should be very concerned by a rival’s recall. The reason? A phenomenon that we call a “perverse halo,” in which negative online chatter about one brand increases negative chatter about rival brands, leading to downstream erosion of stock price and sales.

The current crisis at Volkswagen bears this out. A quick analysis shows that other German car companies have been hit hard by the VW recall, while car companies based in the United States and Asia have remained largely unscathed.

Dire Dieselgate

VW’s global recall of diesel cars that it allegedly designed to mislead environmental regulators could eat up a substantial amount of money from the company’s coffers. The company is charged with deploying software that fooled US emissions testing and using its false ecological ratings to qualify for green car subsidies and tax exemptions. According to the Environmental Protection Agency (EPA), VW actually insisted for a year that the discrepancies were mere technical glitches.

If the allegations are proven, the Volkswagen Group could face fines of up to US $18 billion and a massive reduction in future sales.

Martin Winterkorn, the former chairman and CEO of Volkswagen Group, has said he’s deeply sorry, and Michael Horn, CEO of Volkswagen USA, has admitted that they screwed up. The company is doing its best to restore consumer faith. More than $7 billion have been earmarked to deal with the costs of rectifying the deceptive software and its suspended sales of the deceptive cars in the US.

But such blatant cheating is not easily forgiven. Even a product recall brought on by an honest mistake harms a firm financially and in terms of customer perceptions of the brand (Dawar & Pillutla 2000; Rhee & Haunschild 2006). In the case of Volkswagen, however, pundits have argued that this scandal is worse than a simple recall. It could have disastrous long-term consequences to the company’s reputation, trust and brand equity.

Moreover, it could tarnish the brand image of Germany as an auto manufacturer. No wonder, then, that the German Chancellor Angela Merkel is urging “complete transparency” and has engaged the German Transport Minister, Alexander Dobrindt, to coordinate with Volkswagen.

The pattern repeats

Merkel’s concerns are well-founded.

Our paper on the social media multiplier of product recalls indicates significant negative impact on the sales and stock market performance of innocent brands (from the same country of origin). For example, we find that a one-unit shock in a recalled brand’s online chatter erodes about $7.3 million from the innocent rival brand’s average market capitalization over six days.

For the study, we examined 48 car models from Japanese brands Toyota, Honda and Mitsubishi and American brand Chrysler. But I wanted to see whether we’d find the same patterns for the Volkswagen scandal.

I calculated the abnormal returns for nine automobile brands after September 20th, 2015, the day that VW admitted its deception and issued a public apology. I selected three German brands (Volkswagen, BMW, Daimler), one European (Fiat), two American (Ford and GM), two Japanese (Toyota and Honda) and one Korean (Kia). And I controlled for market-driven fluctuations in price to isolate the effect of the recall by using the major market indices.

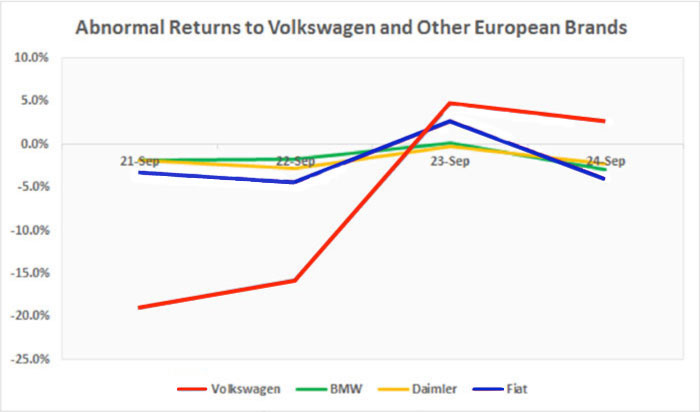

As you can see in figure 1, all four European brands—VW, BMW, Daimler and Fiat—had negative returns just after VW’s dark day. Volkswagen has a very negative abnormal return of -18.95% on September 21st. BMW, Daimler, and Fiat follow suit with -1.8%, -1.8%, and -3.3%, respectively. The returns remain negative until the 22nd for all four brands. Volkswagen recovers on September 23rd but Daimler and BMW are still in negative territory on September 24th.

Thus, there seems to be a negative spillover for not only other German brands but also a European non-German brand.

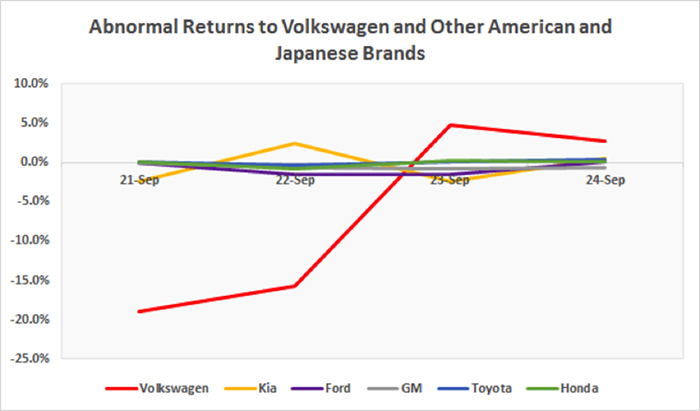

Brands outside of Europe did not suffer the same fate. When I plotted the abnormal returns for VW against the Asian and American cars companies (figure 2), only Kia shows a negative return of -2.4% on September 21st (and it bounces back with +2.4% the next day).

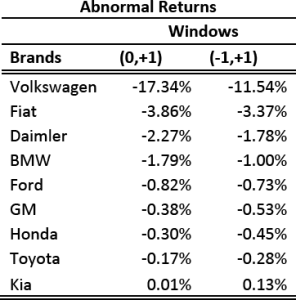

Table 1 shows the abnormal returns for two windows of time: the (0, 1) window, which covers September 21-22 (the first two days after VW admitted deception); and the (-1, +1) window, which covers September 20-22 (from the day before until the day after VW’s admission).

The conclusion is that European brands have suffered most from VW’s recall while Kia, Toyota and Honda seem to be the least impacted.

Nationality as a brand attribute

These results indicate that country-of-origin effects might be in play. Prior research (Hong and Wyer 1989, 1990) suggests that consumers might use “country” as a brand attribute and make similar inferences for brands that are associated with the same country as the recalled brands (and opposite inferences for brands from other countries).

For example, consumers might think that brands of the same country have similar processes to develop a product. However, we find that even Fiat has taken a hit post the scandal. And this despite the positive brand coverage of Fiat after the Pope’s visit this last week when he used a Fiat to travel around.

Indeed, authorities in South Korea have announced pollution control investigations into cars manufactured by Volkswagen and other European car manufacturers. Thus, this scandal could lead to negative spillovers across a continent’s brands.

The downside of chatter

One important driver of the negative reaction of stock market investors could be the investors inferring that consumers will distrust brands of German origin in the wake of the Volkswagen scandal. This could occur because investors will observe negative online chatter on social media and infer that such chatter will affect the future sales and earnings of the firm.

As gathering such online chatter is a time-consuming task, I used Google search data to observe if there was any association between the search patterns of Volkswagen, Daimler and BMW during the Dieselgate scandal. As can be observed from figure 3, there was an increase in search for all three brands, with Daimler having an increase on September 22nd and reaching its peak on September 24th, while BMW reached its peak on September 24th.

Overall, it seems that consumers are using country-of-origin in their perceptions of car manufacturers, and that investors are using their own and other consumers’ inferences to make their investment decisions.

Social media matters a lot.

I have one piece of advice for German brands: for now, at least, be wary of emphasizing that you’re “made in Germany.”